A risk register is a fundamental tool for effective enterprise risk management. It serves as a central repository for documenting, analysing, and tracking risks, providing a clear and comprehensive picture of an organisation’s risk landscape.

A risk register is more than just a list of potential problems; it is a dynamic and essential component of an organisation’s overall risk management framework. It provides an in-depth view of risks that could impact the organisation’s objectives, including, what controls are currently in place and their effectiveness, what treatments are being implemented and their progress, and who has ownership of the risk, controls and treatments.

A risk register is a one-stop-shop for all the organisation’s risk intelligence.

Key Takeaways:

- The risk register provides a structured way to identify, analyse and evaluate risks from across the organisation. This ensures that no potential threats or opportunities are overlooked.

- An effective risk register provides key stakeholders with the information they need to make informed decisions. It helps leaders understand the trade-offs involved in different strategies, determine acceptable risk levels (risk appetite), and select appropriate responses (treatments).

- The risk register shifts the focus from reactive problem-solving to proactive risk management. By documenting controls, assessing their effectiveness, managing treatment plans, organisations can anticipate and effectively manage risks before they materialise, reducing the potential for disruptions and negative consequences.

Defining a Risk Register (or Risk Log)

A risk register, sometimes called a risk log, is an essential part of the risk management framework that systematically identifies, analyses, evaluates risks. Its core purpose is to enable proactive risk management. Instead of simply reacting to problems as they arise, a risk register allows you to anticipate potential threats and opportunities.

It’s more than just a list; it’s a dynamic tool that provides a clear overview of an organisation’s risk landscape. Each entry in the register details key information about a specific risk, including its potential consequence and likelihood and controls and their effectiveness. This structured approach is crucial for prioritising risks and ensuring that resources are allocated to the most significant threats.

A key feature of a risk register is its ability to track accountability and control measures. Every risk is assigned to a risk owner, every control to a control owner, a person responsible for its management and mitigation. The document also records both existing controls and planned actions, ensuring that efforts to manage risks are consistently documented and monitored. This ongoing tracking promotes a culture of accountability and helps an organisation enhance resilience by staying ahead of potential issues.

Why a Risk Register is Important

A risk register is important because it provides a centralised and structured system for managing risk, which is a key component of effective enterprise risk management.

Key Benefits

The use of a risk register provides several critical benefits:

- Visibility: It offers a clear, high-level overview of an organisation’s entire risk landscape, allowing management to understand where the greatest threats and opportunities lie.

- Accountability: By assigning a specific risk owner, control owners and treatment owners to each entry, it establishes clear responsibility for monitoring and mitigating risks.

- Proactive Management: It shifts the focus from reactive problem-solving to proactive identification and management, allowing organisations to address issues before they cause harm to its brand and reputation.

Importance to Australian Standards

In Australia, the use of a risk register is crucial for meeting regulatory and governance requirements. It aligns directly with the principles of AS / ISO 31000, the Australian and international standard for risk management, which provides a framework for integrating risk-based decision-making into an organisation’s governance. For the financial sector, it is also essential for complying with frameworks such as APRA CPS 220, which mandates robust risk management and control. Ultimately, an effective risk register is a core tool for demonstrating due diligence and ensuring compliance with these and other regulatory standards.

What a Risk Register Typically Includes

While formats may vary, a typical risk register includes the following essential components for each identified risk:

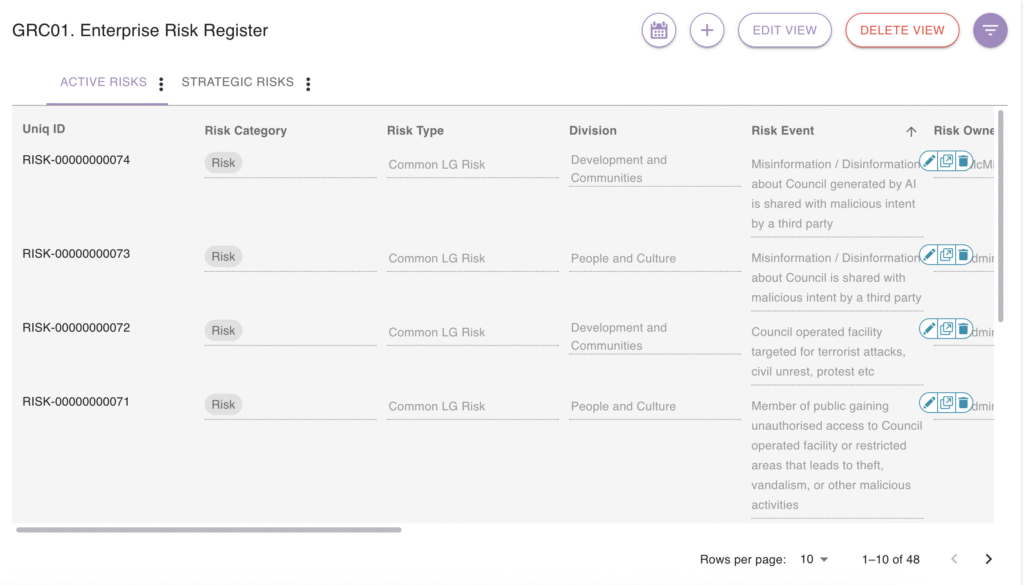

- Unique ID: A unique identifier for easy tracking.

- Risk Category: Categorisation of the risk (e.g., Strategic, operational, enterprise).

- Risk Description: A clear and concise description of the risk event

- Risk Owner: The individual or role accountable for monitoring and managing the risk.

- Causes and Consequences: What sources of risk would cause the risk event to occur, and if it did, what would be the consequences to achieving its objectives.

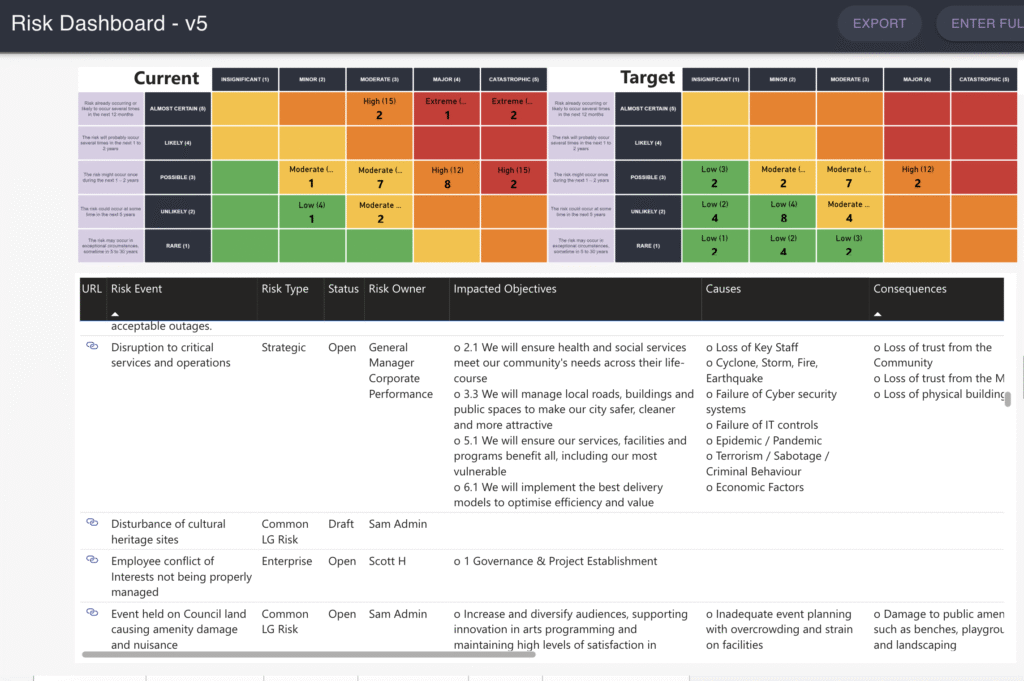

- Likelihood and Consequence: An assessment of how likely the risk is to occur and the severity of its consequences.

- Existing Controls: A description of the systems, processes, and practices already in place to reduce the likelihood or consequence of the risk.

- Control Owner: The individual or role accountable for monitoring controls and their effectiveness.

- Current Risk Rating: The risk rating after existing controls and their effectiveness have been considered.

- Treatment Plan: A summary of the actions planned or in progress to further reduce the risk.

- Treatment Owner: The individual or role accountable for managing the implementation of the treatment plan.

- Target Risk Rating: The risk rating after treatment plans have been implemented.

- Review Date: The date the risk and its associated information will be reviewed and updated.

Digital Risk Registers vs. Spreadsheets

Spreadsheets are a common starting point for risk registers, but they are a legacy approach that introduces significant challenges for modern risk management. Relying on them creates data silos, where different teams maintain separate, disconnected spreadsheets. This fragmentation makes it impossible to gain a unified, enterprise-wide view of risk.

Moreover, spreadsheets provide no real-time data. Risk information is often static and out of date, as it requires manual updates, which reduces an organisation’s ability to make timely, informed decisions. Critical for traceability, spreadsheets also lack a robust audit trail, making it difficult to trace changes or prove due diligence to regulators.

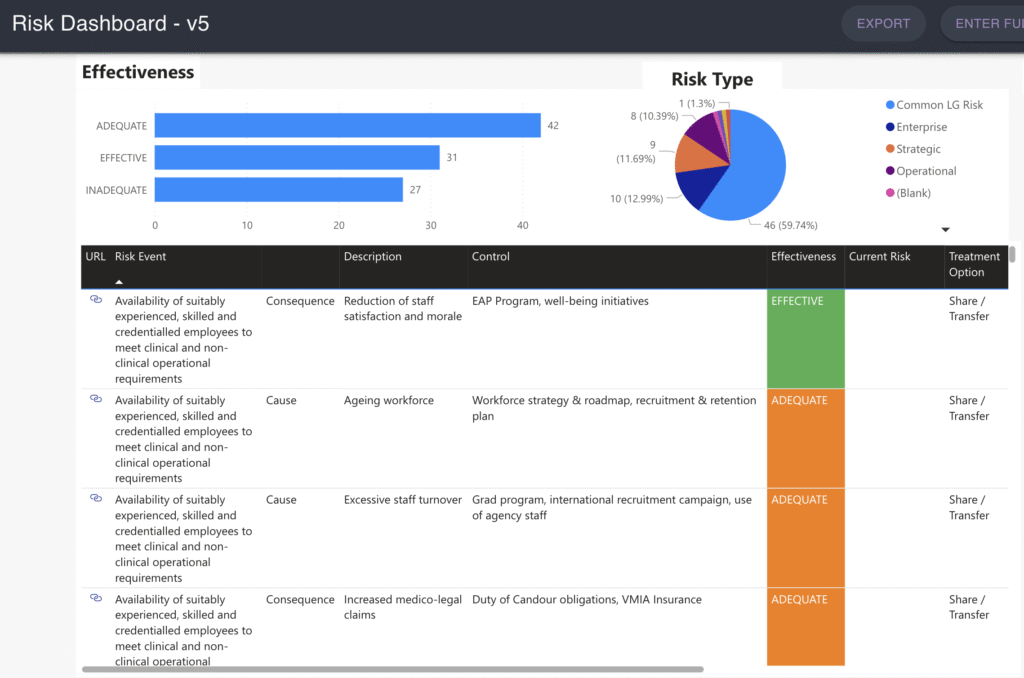

This is where a purpose-built digital solution like Skefto transforms the process. Skefto’s platform provides a centralised, single source of truth for all risks. Its dashboards offer real-time visibility into your entire risk landscape, eliminating data silos instantly. Skefto automates manual tasks, such as workflows and escalations, to risk and control reviews, and ensures accountability by making risk ownership and treatment progress clear. The platform maintains an audit trail, providing a comprehensive and secure record of all risk management activities for compliance and governance purposes. Skefto takes the risk register from a cumbersome document to a dynamic, strategic tool backed by data and insights via its risk dashboards.

How Skefto Simplifies Risk Register Management

Skefto’s one integrated platform delivering unlimited solutions is backed by its flexibility in design. Our risk registers are tailored to your risk management approach. Our risk soultion will transform your risk registers from from a static document into a dynamic, real-time platform. It helps organisations stay ahead of risks with an integrated system that eliminates the fragmented data and outdated information common with spreadsheets.

Skefto simplifies the entire process by providing:

- Compliance Registers: A clear view of all regulatory and compliance requirements, ensuring you never miss a critical deadline. This includes a compliance calendar.

- Risk Registers: Streamlined, standardised workflows for assessing risks, reviewing controls and their effectiveness, tracking treatment plan progress and allowing for consistent and accurate analysis across the organisation.

- Reporting Dashboards: Real-time dashboards that provide instant visibility for leadership, making it easy to monitor key risk indicators and track the progress of treatment efforts.

By centralising risk information and automating key processes, Skefto ensures your oranisation is always audit-ready. It provides an indisputable record of your risk management activities, simplifying compliance and demonstrating a commitment to good governance.

See how Skefto can simplify your Risk Management

FAQs on Risk Registers

Is there a difference between a risk register and a risk log?

The terms “risk register” and “risk log” are used interchangeably. Both refer to the same type of document: a central repository for systematically documenting, tracking, and managing an organisation’s risks.

However, these are not standard definitions. In professional practice and in most risk management standards, “risk register” is the more common and preferred term.

Who is responsible for maintaining a risk register?

The risk register is generally maintained by your central risk team. Risk owners, control owners and treatment owners will all contribute to the maintenance of information in the risk register including risk reviews, control effectiveness reviews and risk treatment progress updates.

How often should a risk register be updated?

A risk register is a live and dynamic and should be updated regularly in accordance with the organisation’s risk policy and procedures. At a minimum a risk register should be updated at least quarterly.