- ENTERPRISE Risk management software

Enterprise Risk Management Software That Grows With Your Business

Built for complex, regulated organisations, Skefto helps you assess, treat, and monitor enterprise risk with real-time visibility, board-ready reporting, and compliance alignment.

A Comprehensive ERM Platform to Manage Risk

Our platform helps CRO’s, Risk Managers, COOs, Quality Officers, CFOs, and Directors of Risk gain real-time oversight, improve control effectiveness, and embed a risk-aware culture across every level of the organisation.

Reduce Administrative Burden

Skefto automates routine risk tasks—like assessments, control reviews, and follow-ups—so your team can focus on what matters. Eliminate spreadsheets and streamline your workflow with centralised, automated tools.

Strengthen Control Assurance

Map and test controls in real time, linked directly to their causes and consequences. See which controls are most critical and track their effectiveness across departments and risk categories.

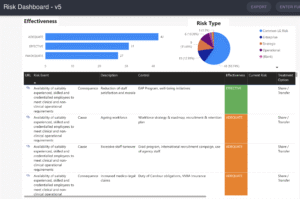

Improve Risk Reporting and Oversight

Use real-time dashboards and configurable reports to monitor KRIs, KCIs, and treatment plans. Present the right insights to boards and executives—clearly, quickly, and with confidence.

Break Down Silos and Share Risk Ownership

Replace fragmented systems with one integrated platform. Promote collaboration by giving all departments shared access to relevant risk data, workflows, and updates—fostering a positive risk culture.

Align With AS/ISO 31000

Skefto embeds AS/ISO 31000 principles into your workflows—risk identification, analysis, evaluation, treatment, and monitoring. Show clear audit trails and demonstrate framework compliance with ease.

Connect Risk With Incidents, Safety, Strategy & More

Skefto’s ERM software seamlessly integrates with our broader GRC platform to give you full visibility across enterprise functions.

Log, investigate, and resolve incidents from one central location. Link events to risks, controls, and compliance records for full traceability and insight.

Track hazards, assign actions, and report on safety performance. Connect safety hazards to your enterprise-wide view and support proactive risk reduction.

Align strategic goals with identified risks, controls, and outcomes. Monitor progress and execution using integrated dashboards and reporting tools.

Ready to Transform Your Enterprise Risk Management?

Whether you’re managing enterprise-wide risk, audit compliance, or continuity planning—Skefto gives you the control and confidence to lead.

✓ Trusted by many organisations across health care, state government, local government, education and many other industries

✓ Built for compliance with AS ISO 31000 and APRA CPS 220, Skefto is the enterprise risk management software Australia depends on

✓ Scalable, secure, and fully configurable

ERM Software FAQs

What is Enterprise Risk Management software, and why should our organisation consider it?

Enterprise Risk Management (ERM) software helps organisations systematically identify, assess, evaluate, manage, and monitor risk across the enterprise. It moves risk management beyond silos, enabling better visibility and informed decision-making. An ERM solution supports improved resource allocation and enhances organisational resilience.

How long does a typical Enterprise Risk Management software implementation take?

Implementation time depends on your organisation’s size, scope, and complexity. Small to mid-sized implementations typically take 1–3 months, while large enterprise-wide rollouts may take 6–12 months. Key factors include data migration, required customisation, internal resources, and the number of solutions being implemented.

What are the common challenges during Enterprise Risk Management software implementation?

- Lack of Executive Buy-In/Engagement: Without leadership support, the initiative can falter.

- Cultural Resistance: Overcoming ingrained habits and a reluctance to change how risks are managed.

- Data Silos and Inconsistent Definitions: Difficulty in consolidating risk data from disparate sources and achieving a common understanding of risk terminology.

- Scope Creep: Expanding the project beyond its initial objectives, leading to delays and cost overruns.

- Resource Constraints: Insufficient budget, internal staff, or specialised expertise.

- Complexity of Risk Landscape: Mapping complex organisational structures and diverse risk types into the software.

- Poor User Adoption: If the software is not user-friendly or perceived as adding administrative burden, users may not embrace it.

- Integration Challenges: Technical hurdles when connecting the Enterprise Risk Management software with other enterprise systems.

How do we choose the right Enterprise Risk Management software for our organisation?

Start by aligning the software to your existing risk framework. Evaluate functionality, usability, scalability, and reporting capabilities. Look for strong integration support, vendor reputation, and data security standards. Consider the total cost of ownership—including training, support, and long-term maintenance.

What kind of training is required for Enterprise Risk Management software users?

Training should be role-specific:

- Executives – Strategic dashboards and oversight tools.

- Risk Teams – In-depth setup, reporting, and assessments.

- Business Units – Practical training for risk input and action tracking.

- IT Teams – Technical support and system management.

Ongoing refreshers help maintain engagement and alignment as the system evolves.

How can we measure the Return on Investment (ROI) of our Enterprise Risk Management software?

Measuring ROI for Enterprise Risk Management software can be challenging but typically involves tracking:

- Strategic Certainty: Effective management of enterprise risks increases the likelihood of achieving our goals and objectives and their impact on the organisation.

- Reduced Financial Losses: Quantify savings from avoiding or mitigating significant risk events (e.g., fines, legal costs, operational disruptions).

- Improved Efficiency: Measure time saved on manual risk reporting, data collection, and analysis.

- Better Resource Allocation: Demonstrate how resources are being redirected from less critical to more impactful risk areas.

- Faster Decision-Making: Though hard to quantify, improved access to risk information can lead to quicker and more effective decisions.

- Enhanced Compliance: Reduction in compliance breaches, audit findings, or regulatory penalties.

- Increased Stakeholder Confidence: While intangible, a strong Enterprise Risk Management program can improve relations with stakeholders, customers, and investor as well as public perception.

- Reduced Insurance Premiums: In some cases, a mature Enterprise Risk Management program can lead to lower insurance costs.

Will Enterprise Risk Management software replace our outdated and disparate solutions, existing spreadsheets, and manual processes?

Ideally, yes. The primary goal of Enterprise Risk Management software is to centralise risk data, automate processes, and provide a single source of truth for risk information. While some organisations may maintain a transition period, the long-term aim is to move away from fragmented, manual processes to leverage the automation, collaboration, and reporting capabilities of contemporary enterprise risk management software.